"You know it is appropriate that this action of the Congress is being timed to the opening of the Asian markets. How appropriate, given the fact that we are losing control of our financial destiny. Mister Speaker, when I was a child, in Cleveland, there was a myth that if you took a shovel and dug a hole deep enough, you could get to China. We're there."

"You know it is appropriate that this action of the Congress is being timed to the opening of the Asian markets. How appropriate, given the fact that we are losing control of our financial destiny. Mister Speaker, when I was a child, in Cleveland, there was a myth that if you took a shovel and dug a hole deep enough, you could get to China. We're there."--Rep. Dennis Kucinich, on the 700 billion bailout

Today, the daddy is continuing to think about how we got into the financial crisis: how is that financial entities like Fannie Mae end up providing more loans to people who couldn't afford to keep up their mortgage, eventually precipitating foreclosures on a grand scale?

An article by The New York Times looks through the eyes of a Fannie Mae executive and helps us to better understand how the crisis happened.

Pressured to Take More Risk, Fannie Reached Tipping Point

“The market was changing, and it’s our job to buy loans, so we had to change as well.” -Daniel H. Mudd, former chief executive of Fannie Mae, the government-chartered mortgage company.

"Almost no one expected what was coming. It's no fair to blame us for not predicting the unthinkable."---- Daniel H. Mudd, former executive, Fannie Mae."

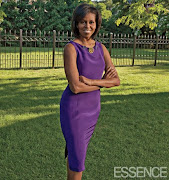

By 2000, chief executives like Franklin D. Raines, above, and the chief financial officer J. Timothy Howard had greatly expanded Fannie Mae. When the mortgage giant Fannie Mae recruited Daniel H. Mudd, he told a friend he wanted to work for an altruistic business. Already a decorated marine and a successful executive, he wanted to be a role model to his four children — just as his father, the television journalist Roger Mudd, had been to him. Fannie, a government-sponsored company, had long helped Americans get cheaper home loans by serving as a powerful middleman, buying mortgages from lenders and banks and then holding or reselling them to Wall Street investors. This allowed banks to make even more loans — expanding the pool of homeowners and permitting Fannie to ring up handsome profits along the way.

But by the time Mr. Mudd became Fannie’s chief executive in 2004, his company was under siege. Competitors were snatching lucrative parts of its business. Congress was demanding that Mr. Mudd help steer more loans to low-income borrowers. Lenders were threatening to sell directly to Wall Street unless Fannie bought a bigger chunk of their riskiest loans. So Mr. Mudd made a fateful choice. Disregarding warnings from his managers that lenders were making too many loans that would never be repaid, he steered Fannie into more treacherous corners of the mortgage market, according to executives.

For a time, that decision proved profitable. In the end, it nearly destroyed the company and threatened to drag down the housing market and the economy.

Dozens of interviews, most from people who requested anonymity to avoid legal repercussions, offer an inside account of the critical juncture when Fannie Mae’s new chief executive, under pressure from Wall Street firms, Congress and company shareholders, took additional risks that pushed his company, and, in turn, a large part of the nation’s financial health, to the brink.

Between 2005 and 2008, Fannie purchased or guaranteed at least $270 billion in loans to risky borrowers — more than three times as much as in all its earlier years combined, according to company filings and industry data. “We didn’t really know what we were buying,” said Marc Gott, a former director in Fannie’s loan servicing department. “This system was designed for plain vanilla loans, and we were trying to push chocolate sundaes through the gears.”

Last month, the White House was forced to orchestrate a $200 billion rescue of Fannie and its corporate cousin. On Sept. 26, the companies disclosed that federal prosecutors and the Securities and Exchange Commission were investigating potential accounting and governance problems.

To read the full story, click here at New York Times.

------------------------------------------------------------

So, if the government needed to bail out Fannie Mae, Fannie Mac, Lehman Brothers and other financial institutions, what should it have insisted of those financial institutions? If Americans are asked to bail out the same people who put us into this crisis, what should Americans through their representatives have insisted from these institutions in return? Deborah White, a democrat from California and freelance writer, talking about the bailout as larceny, gives us a good idea of what SHOULD have been included in the bill but was not:

Taxpayers Foot the Bill, Bankers Keep Profits and Compensation

by Deborah White

Armed with fearfully catastrophic predictions reminiscent of the rushed run-up to the Iraq War, the Bush White House now insists that complete collapse of the world economy is imminent if the Bush administration isn't IMMEDIATELY given a blank check for up to $1 trillion to dole out to the ailing financial services industries and its richly paid executives.

Wall Street Gets Bailed Out by Me When I'm Getting Screwed?

Explains noted economist Robert Reich at TPM Cafe1:

"The public doesn't like a blank check. They think this whole bailout idea is nuts. They see fat cats on Wall Street who have raked in zillions for years, now extorting in effect $2,000 to $5,000 from every American family to make up for their own nonfeasance, malfeasance, greed, and just plain stupidity.

"Wall Street's request for a blank check comes at the same time most of the public is worried about their jobs and declining wages, and having enough money to pay for gas and food and health insurance, meet their car payments and mortgage payments, and save for their retirement and childrens' college education.

TEN REASONS WHY BUSH'S PROPOSED BAILOUT IS LARCENY

* 1. Lack of accountability or transparency, resulting in a "blank check" of up to $1 trillion. Section 8 of the Draft Proposal for Bailout Plan2 reads, "Decisions by the Secretary pursuant to the authority of this Act are non-reviewable and committed to agency discretion... "

That means that the American people can never review and will never know how the $1 trillion was spent by the Bush administration.

* 2. Lack of legal recourse for inappropriate use of $1 trillion in funds. Section 8 of the Draft Proposal for Bailout Plan3 concludes, "... and may not be reviewed by any court of law or any administrative agency."

That means that no matter how the Bush administration spends the $1 trillion, they can't be sued or otherwise held liable for it. Even if the funds are used fraudulently or for any improper or unrelated purpose.

* 3. Lack of specific or objective criteria to determine who should be bailed out, which could result in cronyism, fraud, favoritism based on political affiliation or other misuse of taxpayers' funds.

Recipients of bailout funds are determined solely by the Treasury Secretary. There are no financial benchmarks, nor prohibitions of giving funds to related parties or based on partisan or other discriminatory factors. There are also no prohibitions of kickbacks.

* 4. Lack of specific valuation criteria for "illiquid assets" acquired by the federal government, which would result in overpayments to institutions who made or purchased the bad investments.

The Bush bailout plan is silent on what price the Treasury Secretary must pay the financial services industry to bailout their bad mortgage loans. Will the Secretary pay fair market value (i.e. what the "illiquid asset" is worth today) or will he pay the premium value of what the bad loan used to be worth before the market dropped?

This is important because if the Secretary pays the higher premium price, then American taxpayers are automatically stuck with losses that likely can never be recouped.

Normal business, and consumer, practice is to pay for an asset what it's actually worth on that day (i.e. fair market value). Princeton economist Paul Krugman describes4 "having taxpayers pay premium prices for lousy assets" as "in effect throwing taxpayers’ money at the financial world."

For more, see Concerns about the Treasury Rescue Plan5 by the Brookings Institute.

* 5. Lack of plan, budget or staff to oversee and account for this massive new Treasury Department function, which will inevitably cause a significant expansion in federal government bureaucracy.

This would be a massive undertaking on an unprecedented scale, and would cost billions of dollars in new federal government bureaucracy needs.... costs that would be passed on (coincidentally?) to the next presidential administration, and not borne by George Bush.

And yet, Section 76 of the Bush bailout plan gives unlimited powers to the Treasury Secretary: "Any funds expended for actions authorized by this Act, including the payment of administrative expenses, shall be deemed appropriated at the time of such expenditure."

* 6. Lack of reform or regulation of, or any measure control over, institutions bailed out. Incredibly, the Bush bailout plan requires no changes in the failed practices of the financial services industry.

Economist Robert Reich is spot-on when he writes that, as a bailout condition, Wall Street firms must "agree to comply with new regulations over disclosure, capital requirements, conflicts of interest, and market manipulation.

The regulations would "emerge in ninety days from a bi-partisan working group, to be convened immediately. After all, inadequate regulation and lack of oversight got us into this mess."

--------------------------

As the daddy understands it, there were no requirements for new regulation over disclosure, conflict of interest, or market regulations. There was only talk from Sen. Barack Obama and a few other democratic politicians about holding hearings in the future to look at what got the country into its financial crisis and develop regulations to change it. They should have either had language about re-regulating the financial markets or specific times to hold hearings to do so.

The two central problems with the 700 billion bailout is that it offered no concrete solutions to people trying to save their homes and no new regulations against the very institutions and the people that created the financial crisis. Rep. Dennis Kucinich spells this out in a speech on the house floor. Here is an excerpt from that speech.

We Had Alternatives

by Dennis Kucinich

The following statement was presented on the floor of The House of Representatives after Congressman Kucinich voted against the Wall Street bail out plan, H.R. 1424, the Emergency Economic Stabilization Act of 2008:

The public is being led to believe that Congress has reconsidered its position because we have before us a better bill than we had a few days ago. It is the same bill plus hundreds of new pages for hundreds of millions of tax breaks. What does this have to do with the troubles of Wall Street?

Driven by fear we are moving quickly to pass a bill, which may produce a temporary uptick for the market, but nothing for millions of homeowners whose misfortunes are at the center of our economic woes. People do not have money to pay their mortgages. After this passes, they will still not have money to pay their mortgages. People will still lose their homes while Wall Street is bailed out.

The central flaw of this bill is that there are NO stronger protections for homeowners and NO changes in the language to ensure that the secretary has the authority to compel mortgage servicers to modify the terms of mortgages. And there are NO stronger regulatory changes to fix the circumstances that allowed this to happen.*

We should have created a mechanism for our government to take a controlling interest in mortgage-backed securities and use our power to work out a new deal for the homeowners. We could have done this. We should have done this. But we didn't.

Now millions of Americans will face the threat of foreclosure without any help. And the numbers will soon rise for a number of reasons. Not only because of the Alt-A, jumbo mortgages which will soon be reset at higher interest rates, but because the London Interbank Offered Rate (LIBOR) is pushing up rates on adjustable mortgages and more than half of the US adjustable mortgage rates are tied to LIBOR. Homeowner defaults will grow in significant numbers. Let's see if Congress will be as quick to help homeowners on Main Street as they were to help speculators on Wall Street.

Now the government will have to borrow $700 billion from banks, with interest, to give banks a $700 billion bailout, and in return the taxpayers get $700 billion in toxic debt. The Senate "improved" the bailout by giving tax breaks to people in foreclosure. People in foreclosure need help paying their mortgage, they do not seek tax breaks.

Across our Nation, foreclosures continue to devastate our communities, people are losing their jobs, and the prices of necessities are skyrocketing. This legislation, just like the one we defeated last week, will do nothing to solve the problems plaguing American families or help them to get out from underneath the oppressive debt they have been forced to take on.

Unfortunately, there has been no discussion of the underlying debt-based economy and the role of our monetary system in facilitating the redistribution of wealth upwards.

It is not as though we had no choice but to pass the bill before us. We could have done this differently. We could have demanded language in the legislation that would have empowered the Treasury to compel mortgage servicers to rework the terms of mortgage loans so homeowners could avoid foreclosure. We could have put regulatory structures in place to protect investors. We could have stopped the speculators.

This bill represents an utter failure of the Democratic process. It represents the triumph of special interest over the triumph of the public interest. It represents the inability of government to defend the public interest in the face of great pressure from financial interests. We could have recognized the power of government to prime the pump of the economy to get money flowing through out society by creating jobs, health care, and major investments in green energy. What a lost opportunity! What a moment of transition away from democracy and towards domination of America by global economic interests.

* Emphasis: The daddy's.

Next: The Financial Crisis Part III: Where Do We Go from Here?

.gif)

6 comments:

Kucinich is a whiner. Never leads but complains about everything. At least Obama and McCain tried to do something.

The majority of Americans are sleep on Kucinich. He was my pick from go, last two cycles actually.

china sitting good - the can holdem now w 54 % of our nat debt they have purchased

Thanks daddyBstrong for taking the time to put this information together for the American people. There have been some good shows on news programs explaining the problem with charts that breakdown what you are saying even more. But the poor, elderly and minorities need more information because they do not realize they have been taken again. Congress, the Senate and President have taken us for a ride and now the market continues to drop.

"the poor, elderly and minorities need more information because they do not realize they have been taken again. Congress, the Senate and President have taken us for a ride and now the market continues to drop."

rainywalker: Well said. I'm looking for graphs, charts, etc. I'm checking senators who voted against the bill and economists. Thanks

FYI - for those looking - About.com added 3 new employment sites to their top 10 list:

www.linkedin.com (networking)

www.indeed.com (aggregated lists)

www.realmatch.com (matches you to jobs)

Complete Top 10 Job site list here:

http://jobsearch.about.com/od/joblistings/tp/jobbanks.htm

Post a Comment