"Those who most opposed government intervention in the economy for much of the past two decades were so successful in keeping the government away from regulating activities that should have been regulated, that the consequence is now a greater degree of intervention by the government in the economy.”

"Those who most opposed government intervention in the economy for much of the past two decades were so successful in keeping the government away from regulating activities that should have been regulated, that the consequence is now a greater degree of intervention by the government in the economy.” --Democratic Rep. Barney Frank

"It took a lot of work, but the Senate labored long and hard and produced a mortgage-bailout bill that in important ways is even worse than the measure defeated Monday in the House. Getting senators to vote to force their taxpaying constituents to purchase $700 billion worth of "toxic" assets that the private sector wouldn't touch is not an easy thing to do. So, the Senate Democratic and Republican leadership came up with a plan to bribe taxpayers into forking over the $700 billion by giving $100 billion worth of pork, mandates and tax breaks to favored constituencies. "

--Washington Times editorial

Today, the daddy is feeling the U.S. economic crisis. Specifically, he's feeling that none of the politicians have helped us, as American citizens, to even begin to appreciate the depth of this crisis, its impact on future U.S. policies (regardless of whom the next U.S. president will be) families and communities. And since they have not explained it to us, the daddy thinks that we will have to do the research to better understand it ourselves.

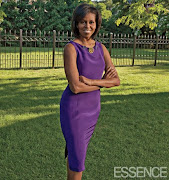

Toward that end, the daddy will be providing articles, comments, charts and quotes on his blog. He will begin with a short piece from Wilkipedia that explains in laymen's terms what subprime mortgages are and how we got into the financial crisis. The second article is by Dr. Boyce Watkins, a Finance Professor at Syracuse University. It provides a black perspective on the crisis and some basic tips to deal with the crisis. The article suggests that it is written for African Americans but, truthfully, its perspective and suggestions would be helpful to other Americans as well.

The daddy apologizes in advance to those who only want him to write about poetry or music, but some things cannot be ignored.

Subprime Mortgage Crisis

from Wilkipedia

The subprime mortgage crisis is an ongoing economic problem that became more apparent during 2007 and 2008, and is characterized by contracted liquidity in the global credit markets and banking system. The downturn in the U.S. housing market, risky lending and borrowing practices, and excessive individual and corporate debt levels have caused multiple adverse effects on the world economy. The crisis has passed through various stages, exposing pervasive weaknesses in the global financial system and regulatory framework.

The crisis began with the bursting of the United States housing bubble[1][2] and high default rates on "subprime" and adjustable rate mortgages (ARM), beginning in approximately 2005–2006. For a number of years prior to that, declining lending standards, an increase in loan incentives such as easy initial terms, and a long-term trend of rising housing prices had encouraged borrowers to assume difficult mortgages in the belief they would be able to quickly refinance at more favorable terms. However, once interest rates began to rise and housing prices started to drop moderately in 2006–2007 in many parts of the U.S., refinancing became more difficult. Defaults and foreclosure activity increased dramatically as easy initial terms expired, home prices failed to go up as anticipated, and ARM interest rates reset higher. Foreclosures accelerated in the United States in late 2006 and triggered a global financial crisis through 2007 and 2008. During 2007, nearly 1.3 million U.S. housing properties were subject to foreclosure activity, up 79% from 2006.[3]

Major banks and other financial institutions around the world have reported losses of approximately US$435 billion as of 17 July 2008.[4][5] In addition, the ability of corporations to obtain funds through the issuance of commercial paper was affected. This aspect of the crisis is consistent with a credit crunch. The liquidity concerns drove central banks around the world to intervene by bailing out defaulting financial corporations in order to encourage lending to worthy borrowers at the expense of tax payers.

The risks to the broader economy created by the financial market crisis and housing market downturn were primary factors in several decisions by the U.S. Federal Reserve to cut interest rates and the economic stimulus package passed by Congress and signed by President George W. Bush on February 13, 2008.[6][7][8] Following a series of ad-hoc market interventions to bail out particular firms, a $700 billion proposal was presented to the U.S. Congress in September, 2008. These actions are designed to stimulate economic growth and inspire confidence in the financial markets. The U.S. House of Representatives rejected the bill on September 29, 2008[9] but congressional leaders said they will revise the proposal to address the concerns of opponents.[10] The U.S. Senate approved an amended HR1424 with a version of the bailout plan on October 1, 2008.[11] On 3rd October, 2008, the amended version of the bill was passed by the House of Representatives as well.

by Dr. Boyce Watkins

Most of you have been watching politicians shuck and jive in predictable ways to try and manage the even more predictable liquidity crisis that has terrorized our financial markets. As a supporter of Senator Barack Obama, I am hopeful that this will serve as the final signal to America that a Harvard graduate with extensive Economics training might be a better choice than a mediocre student who claims to know nothing about the economy. I won’t even mention Sarah Palin, who now makes George Bush the runner-up in the “Unfit to Manage a Burger King” contest. I am not big on Obama-mania, but I tend to be big on common sense. It is also telling that many Americans would sacrifice our nation’s future in order to avoid the discomfort of seeing a Black man in the White House. OK, let me shut up before I say what I REALLY think.

This is not about the pale one called Palin or John McCain’s Black Extermination Plan for criminal justice. It is about USOBA. USOBA doesn’t stand for the “United States of Obama”, rather, it stands for the “United States of Black America”. This is about finding ways to manage, contextualize and internalize this crisis so we can figure out what to do right now. Neither McCain nor Obama is going to take care of you and your family, since politicians tend to take care of themselves (note Treasury Secretary Henry Paulson’s prior affiliation with Goldman Sachs will likely drive his desire to save his Wall Street buddies). The truth is that we are all Presidents of our own households, and as President, your job is to shield your household from the impact of FICA - The Financial Ignorance Crisis of America. Here are some quick thoughts:

1) The government bail-out doesn’t necessarily mean you should bail-out of the Stock Market: If you are invested in the Stock Market, I would strongly consider staying there, especially if you are under the age of 50. In fact, you might want to buy more stocks. Warren Buffett (a man who is sometimes wrong) had it absolutely right when he said that you should “be greedy when everyone else is cautious and cautious when everyone else is greedy.” Drops in the Stock Market can be the best times to invest because the historical data clearly shows that when the US Stock Market declines, it eventually comes back up. Personally, I plan to use this market decline as an opportunity to expand my portfolio. But I am not going to try and pick individual companies: I am going to buy into a diversified mutual fund that spreads my money around the entire global economy.

2) Paying off credit card debt is one of the best investments you can make: Which would you prefer? To possibly earn 10% interest in an investment in the Stock Market or to DEFINITELY save 18% per year on that high interest credit card in your purse? Remember that money SAVED is money EARNED. Get rid of the bulk of your high interest debt before you even consider investing in the Stock Market or anywhere else.

3) Change the game: With all of Barack Obama’s speeches about how Black men need to learn personal responsibility, he may have wanted to save that speech for the rest of America. The typical American consumer has been incredibly irresponsible with spending, saving, borrowing and investing habits over the past 20 years. I grow sick of seeing one article after another attempting to argue that African Americans have a monopoly on irresponsible financial behavior. Don’t believe the hype – ALL OF AMERICA has a problem with financial choices. The goal is not for you to emulate the behavior of the rest of America….it is to set a new standard. Black people can be quite good at saving money. Many of our grandmothers could support a household with two nickels and a hot dog bun. Perhaps we can tap into our natural survival instincts to get us through this mess.

4) This crisis might be the tip of the iceberg: I agree with my respected colleague Paul Krugman at Princeton, who is the only other commentator I’ve heard mention that recent financial problems may be nothing more than a symptom of more serious fundamental issues in the US economy. All I could say when I heard that was “Amen”. Without going into much detail, I can say that it is time to remember that old saying “Learn to save your money, so your money can save you.”

5) Don’t be “scuuuurred” (translation for the uppity among us: “Don’t be afraid”): This is NOT the end of the world. The financial systems are not going to melt down. This is not likely going to be the start of any kind of Great Depression. Truth be told, the Black community has been in a Great Depression for about 400 years! We have survived worse, and just because the economy struggles, that doesn’t mean you have to struggle along with it. Remember that our greatest challenges are usually our greatest opportunities for growth. Learn from this experience, grow from it, and we will continue to move forward.

Your financial liberation is part of your social and spiritual liberation. Let’s use the shake-up as an opportunity to shake ourselves off the plantation. I’m tired of someone else owning me.

Note: In Part II, more on how we got into the financial crisis and at least one politician's reason for voting against the bailout.

.gif)

11 comments:

Hey MacDaddy! I tell ya, this is definitely a time to put faith into action. I'm definitely not scurred though. Cosigning the media will definitely make ya go nuts so I listen and take away info that's truly important (to me at least) and don't freak out about all the doom and gloom they report. Sure, it may be easy for me to say because I'm still employed/not behind financially. It's definitely a time for the entire country to wise up from a financial perspective. Great post as always.

I'm so sick of reading about Sarah Palin, John McCain and this economic mess. I liked your review of Waiting to Exhale.

Great blog and all the people across America, Appalachia, cities and the poor can learn from your pointed comments. Looking forward to the rest of the story!

Thanks for providing some practical information that might help some of us get back on track. Our society is so obsessed with material things -- the Mall is the New Church of America -- that a lot of us just aren't paying attention to the details (I count myself in this group, at least in the past, at a moments where I'm weakwilled). Perhaps we're heading to a rude awakening.

Of course, we're obsessed with consumerism because the Corporation has mastered manipulating us, and they've succeeded at duping us all. It's time for us to wise up to the manipulation, and how it enslaves us to the New Massas: The Corporation.

Hi, CurvyGurl: You know I love it when you visit. And of course you're right: the media will drive you crazy,so you try to take away from tshe info that's important

A lovely read! The way you control your words are impressive.

No wonder the investors are in a turmoil thinking what they should be doing about their investments. Such a sad situation for the country.

The corporate racists are trying to tar and feather Black folks for the mortgage meltdown.

The can barely contain their contempt for borrowers of color.

They need to point their finger at someone and it sure as fuck ain't going to be the CEO of Lehman Brothers or AIG.

I oppose this $700 billion dollar bailout of Wall Street criminals. Many of whom are pals of George Bush. This bailout will do nothing to help get the bad mortgage paper off the books and allow the banks to begin lending again.

If you don't agree, look at the Asian and European markets this morning. They've all opened down and here at home, Wall Street is anticipating another dreary day.

anon: I think I understand. I actually hate writing about this stuff. On the other hand, I feel it's too important to ignore. I also think it's exciting to learn how the financial markets, how it's tied into politics and politicians, and to explore what we Americans can do about it.

rainywalker: Thanks. I'd be really interesting in hearing what you think of my next post that's critical of the bailout.

anon2: Thanks. I will try to provide more practical things we can do to keep this crisis from hurting us too much.

savings: Your sentiments are my own. Let me know what you think of my next post. And don't worry: if you have an opposing view, that will be welcomed also. Blessings.

christopher: Yes, they're blaming black and poor people. I plan to say something about that as well. Stay tuned.

Christopher, Thanks for using the phrase "Corporate Racists." It's straight on. A Faux News commentator actually came out and blamed blacks on the air!

There's an article in today's NYTimes that asserts race is *not* an issue with this presidential election, citing a poll that 66% of Americans "share Obama's values," higher than McCain. This must be intended to make the Corporate Racists feel good about themselves -- can you hear them? "Gosh darnit, it's 2008 and race is no big deal. In fact, some of my best friends are . . . "

I don’t think we can pin this crisis on one political party , ethnic minority or financial group.

We need to take stock and learn. This crisis is a lesson showing us how interconnected all the worlds finances and “we” are. Man’s greed, self interest and egoistic attitudes are the cause of the crisis and the only cure is to change these internal attitudes.

Michael Laitman expands on the financial crisis and offers some fascinating insight in this blog item

David: Welcome and thanks for your input. I'll take a look at the Laitman piece.

Post a Comment